"Leaky Roof? Get It Fixed Fast – Book a Free Inspection Today!"

"Don't let small leaks turn into big problems. Schedule your no-obligation inspection and protect your home from costly damage."

Are you tired of hearing that [Common Belief] is the only way to achieve [Desired Result]? What if we told you there’s a faster, simpler way to get the results you want, without the stress and hassle of [Common Belief]?

Licensed & Insured Roofing Experts

Lifetime Warranty on Materials

Fast, Free, No-Obligation Inspections

Certified Roofing Company

Dallas Apartment & Multi-Family Hail Damage Claims – Maximize Your Payout

"Don't let small leaks turn into big problems. Schedule your no-obligation inspection and protect your home from costly damage."

Don’t Settle for Less – Our Public Adjusters Help You Recover Every Dollar

Dallas Hail Claim Experts

Licensed Insurance Policyholder Advocates

500+ Satisfied Policyholders and Counting

Non-Litigious Solutions

Over $250,000,000 Recovered In

YOU DON'T PAY UNLESS WE WIN | CALL US TODAY

INSURANCE COMPANIES HAVE EXPERTS WORKING FOR THEM. YOU SHOULD TOO!™

Claim Assistance Available 24/7

Insurance Claim Navigator™

Insurance Claim Navigator™

Settle With Confidence. Navigate Your Claim Like a Pro.

Live, expert guidance for property damage insurance claims under $250K.

Flat Fee | Full Value | 100% Satisfaction Guarantee | 2nd Opinions

No Pressure | Settle Faster | Full Service Option If Needed

"Don't let small leaks turn into big problems. Schedule your no-obligation inspection and protect your home from costly damage."

Fast, Free, No-Obligation Inspections. We’ll Be in Touch Within 24 Hours!

Large Loss Hail Claim Experts

Don’t Let Hail Damage Cost You Thousands—We Fight for Maximum Payouts

Hailstorms wreak havoc on commercial properties across Dallas, but insurance companies often undervalue or delay payouts. We make sure policyholders receive every dollar they’re owed.

Recover more for your storm damage claim.

Fast, strategic, and expert-backed insurance claim solutions.

Get a hail damage claim review today—don’t leave money on the table

TPO Experts

Was Your Hail Claim Denied or Underpaid? Get the Compensation You Deserve

If your claim has been delayed, denied, or lowballed, it’s time to take action. Insurance carriers often dispute hail damage claims—but we have the expertise to prove the real extent of your losses.

Public Adjusters for Commercial & Multi-Family Claims

We Fight Insurance Tactics That Reduce Payouts

Helping Policyholders Recover Full Compensation

35 + Successful Projects

Local Roofing Experts

100% Guarantee

One Click. Three Minutes. Total Clarity.

Live, expert guidance for property damage insurance claims under $250K.

Tap Unmute Audio To Hear Video

Navigate Your Claim Like a Pro.

Settle With Confidence.

Tap Unmute Audio To Hear Video

Tap Unmute Audio To Hear Video

Flat Fee | High Value | 100% Satisfaction Guarantee | 2nd Opinions | No Pressure | Settle Faster | Full Service Option If Needed

Flat Fee | High Value | 2nd Opinions | No Pressure Settle Faster | 100% Satisfaction Guarantee

Full Service Option If Needed

Expert Guidance For Claims Under $250K

100% Money Back Satisfaction Guarantee

Navigating insurance claims can feel like a maze. You're not alone. Many policyholders struggle with feeling ignored and helpless, especially when you need help the most. If you seek simplicity and real results, unlock the path to settle smarter with a single click.

We work exclusively for policyholders — not insurance companies — to ensure you receive the full settlement you deserve.

Frustrated with your insurance company’s delays, lowball offers, or outright denials?

Get actionable advice for NEW, DELAYED, DENIED or LOW OFFER claims

Licensed guidance for policyholders with claims under $250,000.

(Large loss claims, click here)

Fire, wind, hail, water, flood, lightning, explosions, vandalism, hurricane, tornado, freeze, business interruption, loss of use, and other claims.

Flat-fee online expert consultation from seasoned professionals.

Trusted by policyholders for 15+ years

No long-term contracts or % fee of recovery

100% Money Back Satisfaction Guarantee

Here’s What You Get:

Strategic 45-minute online consultation with a licensed public adjuster.

Recording and transcription of your session for easy reference.

Checklists to simplify the process.

Detailed review of your policy, policyholder rights, claim submissions and proven strategies to avoid delays, denials, and lowball offers.

Weather Verification Report for hail or wind property damage claims.

Contractor Qualification Checklist.

Recommendations and actionable advice to help you get settled.

All For A Low Flat Fee

Total Value: $2,000+

Only: $250.00

In just 45 minutes, you’ll discover how to avoid costly mistakes, speed up approvals, and maximize your settlement.

Powered By

Public Adjusters

Stop Feeling Overwhelmed and Powerless.

Get The Practical Advice You Need to Get Settled

Fed up?

Turn the tables and get the settlement you deserve without paying a fortune in fees.

Why Claim Navigator™ Makes Sense:

Hiring a public adjuster usually costs 10%-20% of your settlement.

Attorneys can take 33%-40%—plus months or even years of litigation.

With Claim Navigator™, you just pay an economical flat fee—no hidden costs.

Imagine This...

Getting paid what you truly deserve—without the stress and confusion.

Avoiding drawn-out disputes with powerful negotiation strategies.

Securing a faster, higher settlement—all without hidden fees or surprise bills.

Act Now!

Book your risk-free consultation today and get priority access to expert advice for the settlement you deserve with our support!

Book Your Consultation Below!

Important Disclaimer

We’re here to guide you. This consultation does not mean Insurance Claim Recovery Support or any of it's public adjusters are representing you. Claim Navigator Clients are not represented by Insurance Claim Recovery Support public adjusters before, during, or after the consultation. Consultation services are for informational purposes only.

If both parties agree to full representation, a separate contract will be required. If contract for full representation services is executed in the future, any consultation fee(s) paid by you will be credited upon final settlement should you decide to move forward in that direction.

Transparency matters—we’re here to guide, not mislead. That said, you can expect an action plan at the end of our consultation to implement.

Unsure If you need a Claim Navigator™?

Frequently Asked Questions

Why Pay When I Can Handle the Claim Myself or Get a Free Consult Somewhere Else?

Free advice is worth what you pay for it. Price is what you pay, value is what you get. We have over 15 years of experience, have settled over 500 large loss claims, and have a reputation that is second to none. Make no mistake, this is not a sale pitch. You're getting actionable advice and proven strategies that work saving policyholders time, money, and frustration quickly and affordably.

How does the 100% Satisfaction or my money back offer work?

If you’re not 100% satisfied, just request your money back at the end of the call and we'll gladly issue a refund —no questions asked.

What types of property damage claims does Claim Navigator™ handle?

Claim Navigator assists with a wide range of property damage claims, including hail, wind, water, fire, and other covered perils. This is specifically designed for claims under $250,000.

How can Claim Navigator™ help me with my insurance claim?

We provide expert guidance and support to help you navigate the complex insurance claims process. Our services include reviewing your policy, assessing damage, negotiating with your insurer, and maximizing your settlement.

What if my claim was underpaid?

If your insurance company didn’t pay enough to cover the full extent of your damage repairs, you’re not alone. Insurance carriers often undervalue claims, misclassify damage, or use loopholes to reduce payouts. However, you have options to fight for the compensation you deserve.

Why Do Insurance Companies Underpay Damage Claims?

Lowball Estimates – Insurers often undervalue repair costs, leaving property owners paying out of pocket.

Improper Damage Assessments – Adjusters may overlook structural issues or claim damage is "cosmetic" to reduce payouts.

Depreciation & Policy Exclusions – Some policies factor in wear and tear to justify lower settlements.

How to Fight Back & Recover What You’re Owed

Get an Independent Claim Review – A second opinion from an expert public adjuster or claims specialist can uncover missed damages and undervalued repairs.

Demand a Reassessment – You have the right to challenge your insurance company’s payout if it doesn’t align with policy coverage.

Work with Claim Experts – Professionals who specialize in claims can negotiate for a higher settlement and ensure you’re fully compensated.

Don’t Let the Insurance Company Shortchange You

Understanding your policyholder rights is key to protecting your property and financial investment. If your insurer isn’t paying what they owe, take action now. The longer you wait, the harder it becomes to dispute the claim.

Need Help? Our team of damage claim specialists have helped policyholders recover millions. Get Your Claim Review Today.

What if I Need Full Representation Later?

No problem! If you try to work with your insurer without our full representation and then later If you decide to hire ICRS public adjusters to work with your insurer on your behalf, your $250 consultation fee is credited toward our services—so you’re not paying twice. This way, you get expert advice now and the option to upgrade later—without losing a dime.

Storm Specialists

Dallas’s Trusted Storm Claim Experts—HAAG-Certified & Ready to Help

Navigating a large hail damage claim? Our HAAG-certified adjusters specialize in identifying storm-related losses insurers often overlook. We ensure Dallas business owners get the full value of their policies—no excuses, no delays.

35 + Successful Projects

Local Roofing Experts

100% Guarantee

Build Roof Standard

Licensed & Insured

Providing Quality

Leaks and water damage

Get the Full Settlement You Deserve—As Easy as 1-2-3

Step 1: Submit Your Claim for Review

Upload your claim details for an expert assessment to determine your best next steps.

Step 2: Get the Right Support

Our team will guide you through the process—whether you qualify for a complimentary claim review or need expert help through Claim Navigator.

Step 3: Claim What You're Owed

Meet with our large-loss public adjusters to develop a strategy for maximizing your insurance settlement.

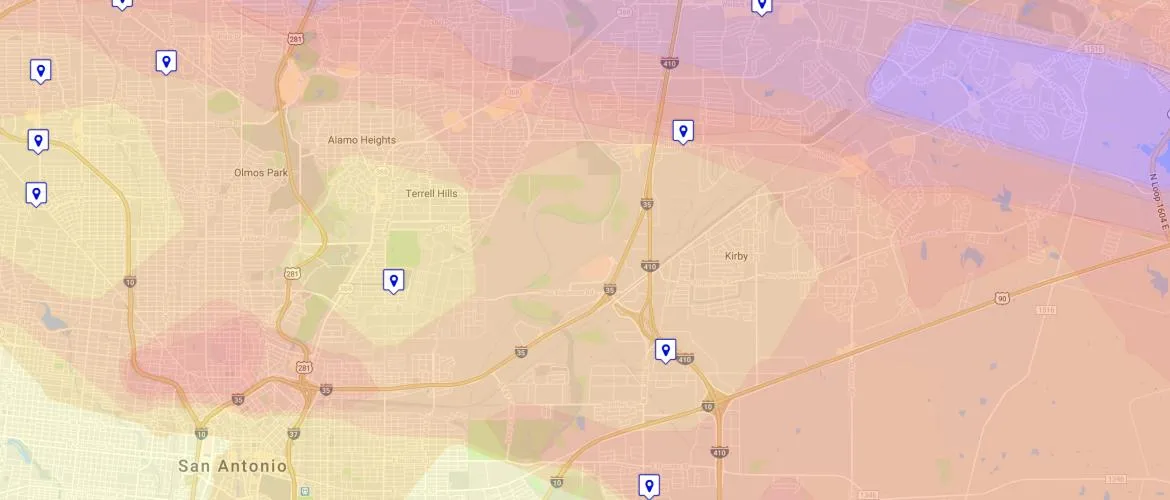

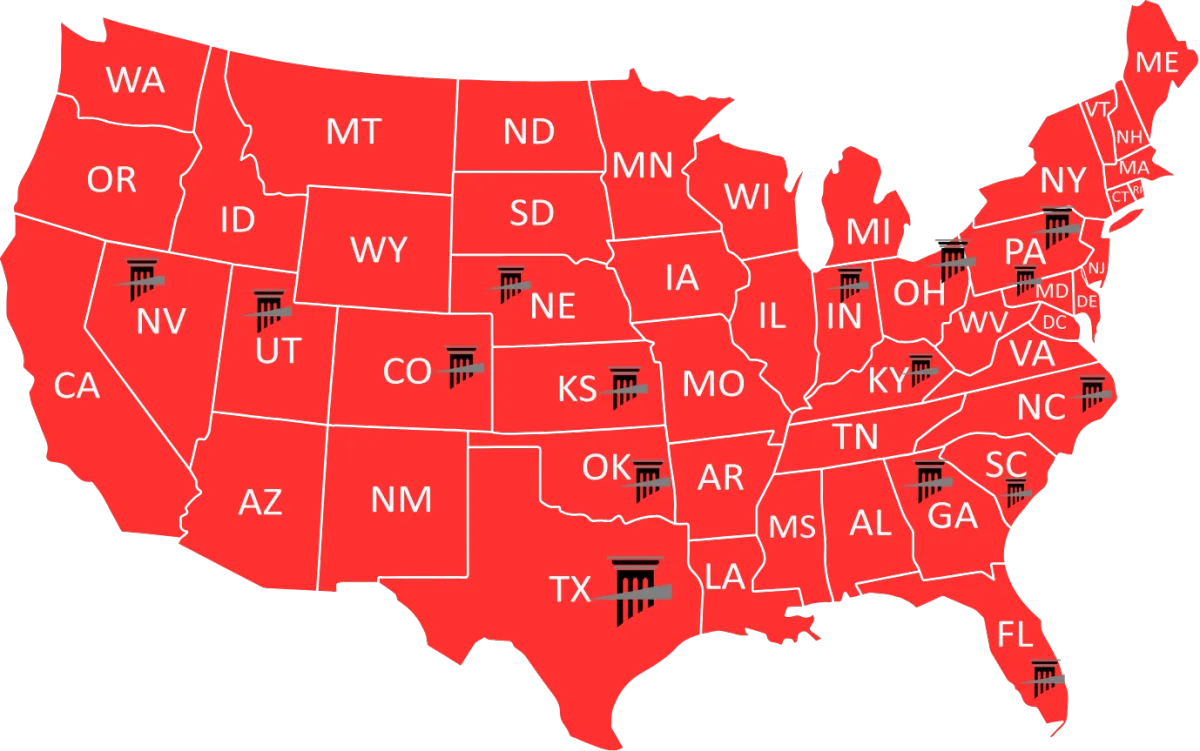

Licensed Public Adjusters In 16 States:

Why Choose Claim Navigator?

15 + Years of Experience.

Proven Results

Successfully settled hundreds of millions in property damage claims.

Property Damage Insurance Claim Experts

500+ large-loss claims settled fairly & promptly.

Avoid Unnecessary Litigation

Underpayments, delays, & wrongful denials.

Licensed Public Adjusters Nationwide

We work exclusively for policyholders, not insurers.

Verifiable Success

Increased settlements over initial offers by 20% to 3,830%+

What Our Clients Have To Say

"Thank you Scott"

Scott responded to my inquiry and took the time to listen and understand our unpleasant experience dealing with our insurance claim. Although I did not utilized his service, he gave me a sound, professional advice and offered to help when he referred me to his engineer. They replied promptly and I was able to have better understanding of the situation. Thank you Scott!

- Haidee J.

"I would highly reccomend"

Words can’t describe how grateful we are for the consultation and claim evaluation we had with Scott. Full disclosure we were unable to work with him due to limitations of our scope. We wanted to properly recognize Scott for the honest and genuine passion he put in to not only our claim, but the way he runs his business in general. We hadn’t had such clarity of next steps since this began in 2020. I would highly recommend this business to everyone spinning their wheels in this process!

- James M.

"I came across this company and had none of those bad feelings"

This was not the first public adjuster I called. I called a different company first but they gave me a bad feeling on the phone. Too aggressive. Didn't feel trustworthy to me. So, I kept looking. I came across this company and I had none of those bad feelings. Scott, the guy who took my call, seemed very knowledgeable and I felt I could fully trust him. As it turned out, he told me that my claim was fairly simple and I didn't need the full scope of his service and fees. But, without charging me a fee, he gave me some needed advice on this whole matter of insurance claims which I needed. And told me I could call him back to ask another question or two if necessary. I would recommend this company for these services.

- Katie H.

You’re serious about [Desired Result] and want a quick, easy-to-follow guide to get there.

You’re struggling with [Common Pain Point] and need a clear path to [Desired Outcome].

You’ve tried other solutions but haven’t seen results and are ready for a proven approach.

You’ve tried other solutions but haven’t seen results and are ready for a proven approach.

You’ve tried other solutions but haven’t seen results and are ready for a proven approach.

ATTENTION: TARGET AUDIENCE

How To Desire Without Doing Z To Achieve Goal

Download the free report and take your marketing to the next level

Innovation

Fresh, creative solutions.

Integrity

Honesty and transparency.

Excellence

Top-notch services.

Facebook

LinkedIn

Youtube